Table of Contents

As the holiday season caps off a transformative year in global finance, U.S. stock markets opened with subdued movements on December 24, 2025, building on the S&P 500’s record close from the previous day. With traders gearing up for a shortened Christmas Eve session, attention has pivoted to surging commodities, particularly gold, which shattered records yet again. This comprehensive Dow Jones today update delves into market performances, key economic influencers, the explosive rise in gold prices, and broader implications for investors, including ties to insurance strategies and economic policies. Whether you’re tracking USD strength, precious metals investments, or global trends like U.S. policy shifts under the Trump administration, this analysis provides essential insights for navigating 2026’s financial landscape.

Wall Street Christmas Tree in New York: 2025 Guide

In a year marked by economic resilience amid geopolitical tensions and interest rate adjustments, the Dow Jones Industrial Average (^DJI) has been a bellwether for investor sentiment. As of early trading on December 24, the index edged up modestly by 0.2%, adding about 98 points to hover around 48,540. This follows a 0.16% gain on December 23, where it closed at 48,442.41 after climbing 79.73 points. The broader market reflected similar caution: The S&P 500 inched up less than 0.1%, extending its all-time high streak, while the Nasdaq Composite slipped 0.1%. Pre-market futures had hinted at a tepid start, with Dow futures down 0.1%, underscoring the low-volume holiday dynamics.

Markets are operating on an abbreviated schedule today, closing early at 1:00 p.m. ET for stocks and 2:00 p.m. ET for bonds, ahead of a full closure on Christmas Day, December 25. Trading resumes normally on December 26, but with volumes expected to remain thin, volatility could emerge from retail-driven moves. For more on holiday trading hours and their impact on your portfolio, check this guide on Holidays and Trading Hours – NYSE.

U.S. Stock Market Open: A Quiet Prelude to the Holidays

Wall Street’s Christmas Eve session embodies the classic “holiday lull,” where institutional traders wind down, leaving room for lighter, more unpredictable activity. This year, the quiet open aligns with broader 2025 trends: A resilient U.S. economy has propelled major indices to new heights, but lingering concerns over inflation, Federal Reserve policies, and global uncertainties have tempered enthusiasm. The Dow’s year-to-date performance has been robust, with gains reflecting strong corporate earnings in sectors like manufacturing and finance, yet December has seen a pullback, with the index down 5.3% for the month as of recent data.

Dow Jones Industrial Average (DJIA): A Guide to Trading the DJ30 …

Historically, Christmas Eve trading often favors bulls, with the “Santa Claus Rally” phenomenon—a period from December 24 through January 5—delivering average returns of 1.3%. This seasonal uplift could provide a year-end boost, especially as retail investors step in amid reduced professional participation. However, external factors like Bitcoin’s minor dip to $87,200 and ongoing job market softness (including challenges in seasonal hiring) add layers of caution. For deeper dives into seasonal market patterns, explore this article on Will the Santa Claus Rally Deliver This Winter—and Lift Stocks in 2026.

Key Drivers Shaping Today’s Market

Several macroeconomic elements are at play this Christmas Eve. Yesterday’s revised third-quarter GDP data, showing stronger-than-expected growth, bolstered sentiment. Real GDP expanded at a robust pace, highlighting U.S. economic strength despite headwinds like higher interest rates. This data, delayed but positive, fueled the prior session’s gains and continues to influence trading today.

The U.S. dollar index softened to 97.93, while the 10-year Treasury yield dipped below 4.16%, signaling mixed views on Fed policy into 2026. With the Federal Reserve having executed its final rate cut of 2025, markets are pricing in potential pauses or hikes amid persistent inflation concerns. Oil prices provided a slight lift, rising 0.4% to $58.60 per barrel for WTI, supporting energy sector stability.

Geopolitical and policy shifts also loom large. Incoming Trump-era policies, including potential tariffs and deregulation, could reshape trade dynamics and boost domestic manufacturing, impacting the Dow’s industrial components. For investors, this underscores the need for diversified portfolios, perhaps incorporating gold as a hedge—more on that below. Learn more about Stock Market Under the Trump Administration | U.S. Bank for strategic advice.

Sector Highlights: Tech Pullback, Energy Resilience, and More

Diving deeper into sectors, tech stocks, which drove much of 2025’s rally, experienced a minor retreat. Nvidia (NVDA) fell 0.7%, Broadcom (AVGO) dipped 0.1%, and Amazon (AMZN) was marginally lower in early trading. This follows AI-fueled gains on December 23, but holiday thinning may amplify swings. Conversely, energy held firm, with BP (BP) down just 0.3% after announcing a $6 billion sale of its Castrol stake to refocus on core operations.

Tech Weekly: Tech Stocks Feel the Heat Amid Valuation Fears | INN

Other sectors showed mixed results: Financials benefited from yield stability, while consumer discretionary faced pressure from holiday spending data indicating moderation. The Conference Board Leading Economic Index suggests continued expansion into 2026, with GDP growth forecasted at 1.8%. For sector-specific insurance tips, such as protecting tech investments, visit The Short Guide to Insure Stock Market Losses – Investopedia.

Gold and Precious Metals Surge: Breaking Down the Record Rally

Gold’s performance steals the spotlight this Christmas Eve, with prices surging to unprecedented levels for the third consecutive day. Spot gold reached $4,504.87 per ounce early on, up from prior closes, while futures hit $4,516.70, marking a 0.2% daily gain and over 70% year-to-date. By mid-morning, it settled around $4,483, reflecting a $15 uptick and a staggering $1,919 annual increase. This eclipses the all-time high of $4,525.03 set earlier in December 2025.

Silver mirrored the momentum, breaching $70 per ounce with 150% YTD growth, while platinum and palladium soared 160% and 100%, respectively. Why the rally? Geopolitical tensions, a softening USD, and inflation hedging are primary drivers. Weak U.S. jobs data and Fed rate expectations have amplified safe-haven demand, pushing gold past $4,500—a milestone analysts predicted but few expected so swiftly.

Gold, silver rise to record highs amid rising U.S.-Venezuela …

Historically, gold thrives in uncertainty: From 1970 to now, annual averages show steady appreciation, with 2025’s $2,408.08 average underscoring its role as an inflation buffer. For investors, this surge presents opportunities in physical gold, ETFs, or mining stocks. But volatility warns of risks—consider How to Insure Gold and Silver Bullion | Precious Metal Insurance. External resources like the Gold Price History Chart on Macrotrends offer visual timelines.

Broader Economic Context: GDP, Yields, and Long-Term Projections

Zooming out, today’s market reflects 2025’s economic narrative. Real GDP growth slowed to 2.5% over the four quarters, down from 3.2% in 2024, yet remains solid. Forecasts for 2026 anticipate 1.8% expansion, tempered by potential government shutdown effects shifting growth. Treasury yields, with the 10-year at 4.24% end-of-December, signal rate-cut doubts.

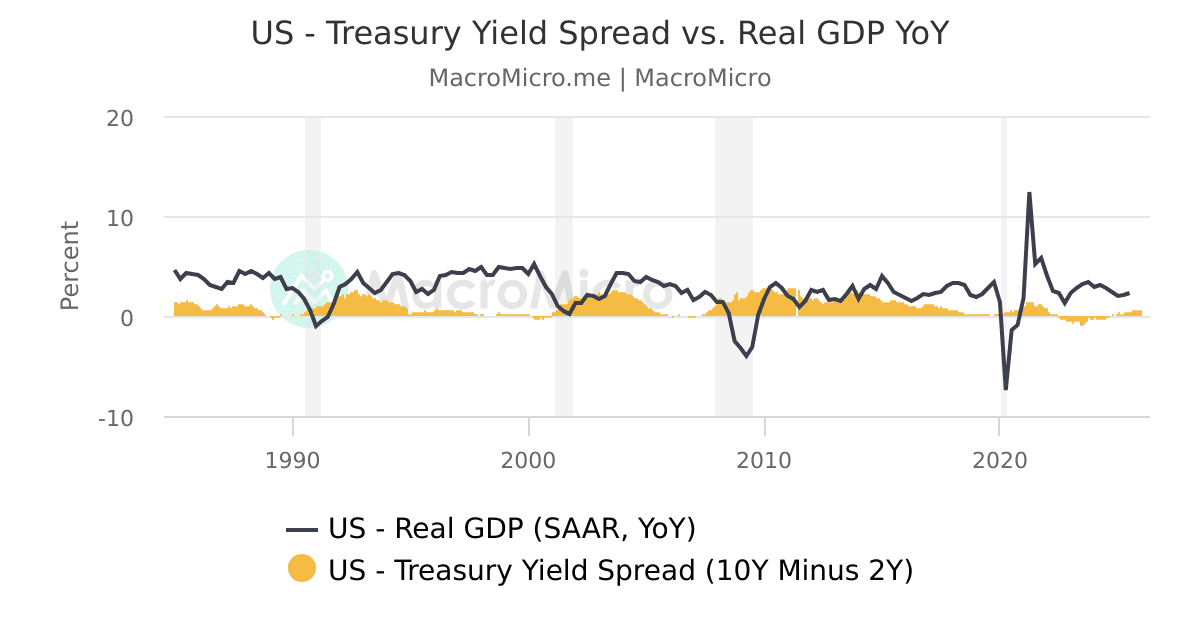

US – Treasury Yield Spread vs. Real GDP YoY | MacroMicro

Long-term, the CBO projects outlays rising 3.3% of GDP through 2055, driven by debt and interest. This could pressure insurance premiums, especially in life and health sectors. For advice, read How Economic Indicators Shape Insurance Rates | The Zebra.

Global Influences: Trump Policies, Geopolitics, and Finance Ties

Global events amplify U.S. market moves. Trump’s declaration of Christmas Eve as a holiday underscores policy whims that could affect trading norms. Broader agendas, like trade resets, may fuel gold’s haven status amid USD fluctuations. In Nepal, for instance, USD exchange trends tie into global gold demand, impacting remittance-based economies.

For outbound perspectives, consult Markets: Indexes, Bonds, Forex, Key Commodities, ETFs – CNBC or Gold News | Today’s Latest Stories – Reuters.

Market Outlook: Santa Rally and 2026 Horizons

Could the Santa Rally propel stocks into 2026? Historical data suggests yes, but challenges like a cooling job market persist. Optimism stems from GDP resilience and commodity strength, potentially lifting the Dow toward 50,000.

Santa Claus Rally – What Is It, History, Chart, Examples

For insurance angles, volatile markets heighten needs for asset protection—explore How can life insurance help when markets are volatile?.

Conclusion: Navigating Finance in Uncertain Times

As December 24, 2025, unfolds, the Dow’s steady open and gold’s records highlight a year of contrasts. Investors should blend stocks with precious metals for balance, while monitoring policies and data. Subscribe to Insrivo.com for daily updates on Dow Jones, gold prices, insurance guides, and Trump-era finance shifts. For more, visit Live Gold Price Chart or external sites like Yahoo Finance DJI History.

Checkout more here.